HR training, delivered seamlessly online for busy professionals

We surveyed more than 1,000 executives and senior leaders across several sectors and launched our Beyond Skills report based on the findings last month. Our aim was to assess the growing capability chasm. We found that chasm was identified by 60% of respondents as a real problem in their organisation. But what is a capability chasm? We define it as the critical imbalance between the capabilities people have and the ones they need.

A lot of businesses changed through 2020. In light of that, we mapped how the capability chasm compares to the changing attitudes around learning and development. Unsurprisingly, we found that developing peoples’ capabilities is essential to business success. A clear indicator of that was that 71% of businesses that saw growth last year did increase their training budgets.

But how does this information apply to the capabilities chasm in the financial services sector, specifically? Read on to find out.

What the Beyond Skills report highlighted for the financial services sector?

Likely as a result of tension between business-as-usual and all the disruption through the past 10 years, the financial services sector reported the weakest growth of the sectors we surveyed. Along with that lack of growth, more than half the leaders we spoke to in this sector reported cuts to their learning and development budgets. The combination of those two factors will have an impact on the sector’s ability to grow sustainably.

In addition to growth, people we spoke to in the financial services sector were also concerned about how those cuts to learning and development would impact employee mental health. This could be another consequence of continuing to prioritise survival over capabilities, a strategy that could prove to be short-sighted. Respondents seemed to recognise this, with 63% reportedly worried about the future implications of their organisation’s skills gap.

How does financial services differ from other industries?

The other four industries we surveyed had both similar and different opinions surrounding the capabilities chasm.

- Fast-moving consumer goods respondents were the least likely to report a prioritisation of survival over capability at 59%.

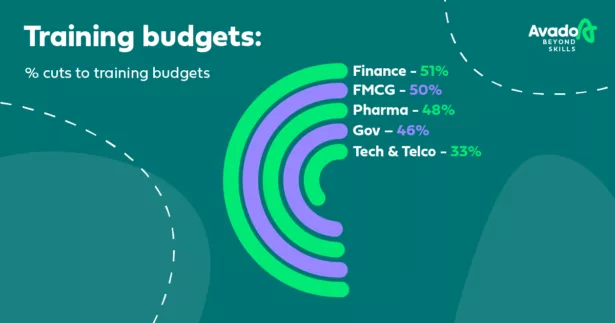

- While financial services respondents reported the most cuts to training budgets at 51%, tech and telco reported the least, at 33%.

- Pharma had the smallest reported capabilities gap of any of the five sectors we surveyed.

- As with financial services, 46% of government and public services respondents reported decline rather than growth.

What should you do next?

Based on our research and our daily interactions with people who work in the financial services sector, we know that several organisations are keen to go through a transformation. That is particularly the case when it comes to the way customers engage with them. As such, they are spending a great deal of resources on tech and automation to create a more digital-first experience.

That focus on creating a better experience for customers is, of course, key. But with it should also come developing employee skills that align with a more tech-focused customer journey. That means investing in people’s digital and data skills, as well as shifting mindsets to further boost that organisation-wide transformation.

Combining these two approaches will allow the sector to continue moving towards that transformation and help boost their ongoing investment in tech. Without working towards plugging those data-driven and digital capabilities gaps, that investment will not go as far, and it won’t result in sustainable change.

About Avado

At Avado, we believe that true transformation isn’t digital, it’s human. We build professional future skills to help diverse talent access and accelerate careers through award-winning learning experiences that deliver tangible and measurable impact. We upskill people, uplift culture and future-proof organisations in a fast-moving world.

Avado is proud to be a people-transformation partner to some of the largest and most innovative organisations in the UK including: Google, BT, NHS, British Airways, UK Civil Service, Legal & General and AstraZeneca.

To find out more, visit www.avadolearning.com

4 min read

4 min read