When it comes to getting the best kind of qualification in HR and L&D, the CIPD (Chartered Institute of Personnel and Development) is the gold standard. But what is the CIPD, and how can it benefit your career in HR and L&D? Read on to learn about how to get a CIPD qualification and how it can benefit you, no matter where you are in your career.

Also Checkout: A Guide To CIPD HR & L&D Courses

What is CIPD?

The CIPD is an independent, non-profit organisation that was founded more than 100 years ago. Now, it includes a community of around 140,000 members, and their qualifications are respected by employers around the world.

When you get a CIPD qualification, you can be confident you’re getting the best HR or L&D programmes available. Each one is designed by industry-leading experts to include all the latest thinking and ideas.

The CIPD offers a range of qualifications that help build world-class practices in people management.

What are the benefits of a CIPD qualification?

There are many benefits to having a CIPD qualification in HR or L&D on your CV. One of our recent learners who indicated she was just part-way through her qualification on her LinkedIn profile was able to get a job in L&D.

That’s what a CIPD qualification does. You’ll have the ability to demonstrate your skills in HR or L&D to employers which can help you stand out amongst other applicants.

As well, a CIPD qualification could help you earn more money. When you are CIPD Level 3 qualified, for example, and working as an assistant, you could earn £10,000 more than someone without that certificate.

With a higher-level qualification and a role as an HR manager or director, that salary could be upwards of £60,000.

What has changed with the CIPD qualifications?

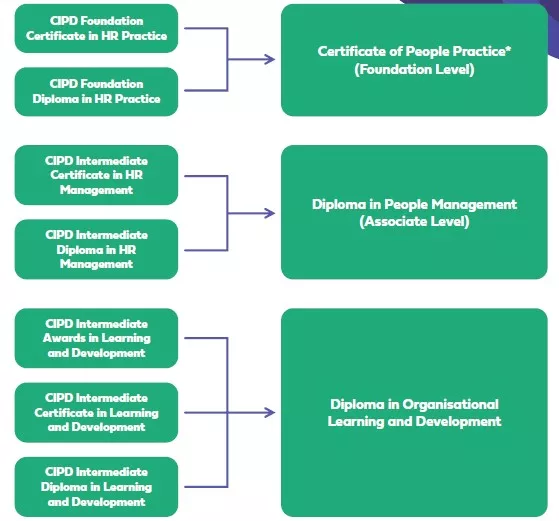

In 2021, the CIPD changed all their qualifications. Even though the names have changed, they are still designed to support people professionals’ progression through their careers.

As of this year, both HR and L&D foundation certificates are under one single Level 3 qualification. So, it’s not as focused as it used to be on certain topics, like designing and delivering training. However, as you progress through the new Level 3, you can choose to focus more on either HR or L&D.

Level 5, however, is still split up. Both HR and L&D have their own, dedicated Level 5 Diploma qualification. There is still some overlap between the two new Level 5 qualifications, but each one has different option units that help keep them focused.

What is brand new in the Level 5 qualifications is coverage of topics like diversity and inclusion, wellbeing and global people management.

See below for a chart that explains how the former CIPD qualifications have shifted into the new ones.

The CIPD Profession Map

Learning Outcomes of the new qualifications are tied to the CIPD Profession Map.

The Map has been widely used in learning content since November 2018 so you can clearly see your progress. Whatever option you choose, you’re getting the very latest content and teachings from CIPD.

CIPD qualification types and levels

At Avado, we offer three different CIPD qualifications: Level 3 Certificate in People Practice, Level 5 Diploma in People Management and Level 5 Diploma in Organisational Learning & Development.

What is CIPD Level 3 Certificate in People Practice?

This foundation-level qualification provides a solid base in HR and L&D, and as you work through it, you can choose to either focus on HR or L&D individually or take on a mixture of the two.

Who is the CIPD Level 3 Certificate in People Practice for?

The Level 3 qualification is for people with minimal or no HR experience. It’s about as difficult as an A-level.

How long does the CIPD Level 3 Certificate in People Practice qualification take?

It will typically take you about eight months to complete the Certificate.

What is the CIPD Level 5 Diploma in People Management?

Building on your existing knowledge of HR, you’ll get a sound understanding of how HR fits into achieving strategic objectives and how data can be used to improve performance.

Who is the CIPD Level 5 Diploma in People Management for?

This course is aimed at those with some HR experience looking to progress to management level.

How long does the CIPD Level 5 Diploma in People Management qualification take?

It will typically take you about 12 months to complete the Diploma.

What is the CIPD Level 5 Diploma in Organisational Learning & Development?

This Diploma is ideal if you want to formalise your existing experience, skills and knowledge in L&D. You’ll study the core knowledge and behaviours in the field and extend these through specific units to further specialise in L&D.

Who is the CIPD Level 5 Diploma in Organisational Learning & Development for?

This course is for those with some L&D or HR experience looking to take the next step in their professional L&D development.

How long does the CIPD Level 5 Diploma in Organisational Learning & Development qualification take?

It will typically take you about 12 months to complete the Diploma.

The table below breaks down each level, the associated job roles, and estimated salaries:

| Level | Job Roles | Estimated Salary |

| 3 (Foundation) | Assistant, Co-ordinator, Administrator | £18,000-£25,000 |

| 5 (Associate) | HR Manager, HR Advisor, L&D Consultant | £25,000-£50,000 |

| 7 (Advanced) | HR Director, Strategic Planner, L&D Director | £50,000+ |

Get qualified now

Interested in gaining your CIPD qualification and progressing your career in HR or L&D? We’re ready to help.

About Avado

At Avado, we believe that true transformation isn’t digital, it’s human. We build professional future skills to help diverse talent access and accelerate careers through award-winning learning experiences that deliver tangible and measurable impact. We upskill people, uplift culture and future-proof organisations in a fast-moving world.

Avado is proud to be a people-transformation partner to some of the largest and most innovative organisations in the UK including Google, BT, NHS, British Airways, UK Civil Service, Legal & General and AstraZeneca.

To find out more, visit www.avadolearning.com

6 min read

6 min read